RLOS – Retail Loan Origination System

1. Product Introduction

The RLOS Loan Origination and Management Software is a system for managing the workflow chain of customer information registration, customer information changes, loan approval processes for overdraft limits, overdraft information change requests, and query requests. It helps manage tasks and shortens the time required to issue and approve overdraft limits for customers.

2. Goals/Benefits of the Product

The RLOS Loan Origination and Management Software digitizes the entire loan origination and management process, from when credit officers first engage with customers seeking credit, through approval, and includes steps for receiving applications, assessment, approval, and post-approval control for all types of customers.

Benefits of the RLOS Loan Origination and Management Software:

- Reduces service delivery time

- Enhances customer satisfaction

- Utilizes current resources and minimizes costs

- Strengthens risk management and compliance

- Ensures process integrity

- Supports decision-making control

3. Main Features of the Product

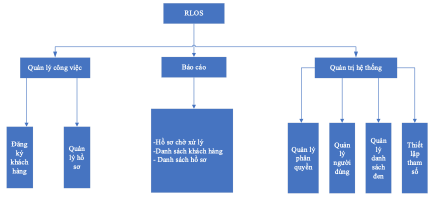

The RLOS Loan Origination and Management Software includes three main modules: Task Management, Reporting, and Software Administration. Details are illustrated in the following diagram:

4. Conclusion

Implementation at branches and People’s Credit Funds supports reducing the loan application approval time from 7 days to 1-2 days, an average reduction of 80% in approval time. This minimizes paperwork, enhances transaction productivity and quality, and contributes positively to environmental protection.

The solution primarily targets banks, aiming to optimize the bank’s lending process. By digitizing data, banks will save time on lending processes, eliminating the need for paperwork procedures